Rodrigo Ibarrola

Regardless of whether or not the measurements reflect the reality of each Paraguayan household (an objective impossible to achieve faithfully), it is not unusual to question the inflation reported by the Central Bank of Paraguay, measured by the Consumer Price Index (CPI), which has been prepared since 1938. In the following lines, we intend to shed light on this form of measurement.

First of all, it is important to point out that the CPI is not a cost of living index, since this concept encompasses goods and services to achieve or maintain a certain level or social welfare, a situation of complex measurement due to the subjective elements involved in the valuation of each household. Bearing this in mind, we emphasize that the CPI measures the price level of a basket of selected goods and services, but not the cost of living.

The CPI includes only consumable expenditures that are made through monetary transactions, taking the living or household expenses (not individuals) as the unit of reference. Expenditures, for example, made through barter and self-use, are not included. When considering only consumption, investment or fixed asset expenses are not included, such as housing, purchase of bonds, pension contributions, donations, savings deposits. The values collected correspond to retail prices (those we see in grocery stores or supermarkets, excluding bargains) in local currency.

The selected goods and services are intended to represent, as faithfully as possible, a basic package for an average family. But how are the goods and services to be selected determined? To define this, what we know as the Household Budget Survey (HBS) is carried out from time to time. The most recent survey was conducted for one year, between September 2015 and September 2016. The result was the CPI Base 2017. The correct determination of the basket of selected goods is an imperative, since habits vary over time, in addition, products are either improving, or, directly, are replaced by others. Below are the main goods included and excluded in the latest HBS.

Table 1. Main goods included and excluded in the CPI basket

Source: Central Bank of Paraguay (BCP)

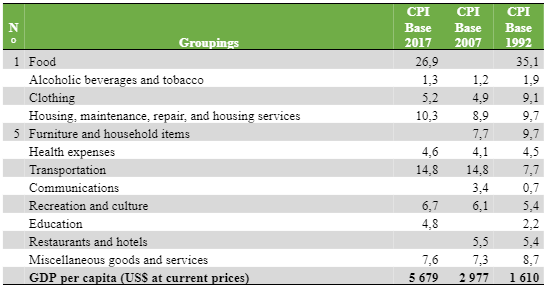

For the Base 2017 CPI, some 1882 households in the metropolitan area were used as reference, with adjustments by socioeconomic strata from the 2002 National Population and Housing Census. A total of 6441 consumer items were identified, gauging the proportion of total household expenditure for each good. At the end of this work, only those items representing a proportion of at least 0.03% of total consumption expenditure were selected, some 465 items (358 goods and 107 services). These were split into 12 divisions, 56 groups and 155 subgroups, using as a guide the Classification of Individual Consumption by Purpose (CCIF), following the standard international manual prepared and recommended by the United Nations Statistics Division. The result by grouping (proportion of total expenditure) is shown in Table 2.

Table 2. Measurement by grouping the goods and services

Source: Central Bank of Paraguay (BCP). Note: In line with the trend observed in other countries, the share of food decreases as per capita income increases.

Once the group of goods and services has been defined, the task of collecting prices is next. The directory of establishments includes 1150 businesses, composed of supermarkets, grocery stores, greengrocers, butchers, restaurants, bakeries, distributors, markets, street stores, multistores, perfumeries, hardware stores, pharmacies, clinics, hospitals, specialized computer stores, transportation, etc. These are taken from the reports of the families interviewed in the HBS. In general, it is required that the establishments are stable over time, to allow the evolution of prices to be traced. The prices of diesel oil and other basic services are taken from the state administering entities.

Collections are made on a weekly, biweekly or monthly basis, depending on the type of item. For example, food and non-alcoholic beverages are collected on a fortnightly basis; vegetables and fruits, on a weekly basis; other goods and services, on a monthly basis. In total, the BCP collects around 10980 prices. Values referring to items in liquidation, with discounts or subsidized items are excluded.

Next, the variation index of each item is calculated, derived from the change in the prices collected with respect to the prices of the previous month. The measured average of the indexes of each item (called “elementary”) will give rise to the aggregate indexes of each subgroup, group and grouping, whose relative weight was defined in the Household Budget Survey. Finally, the Consumer Price Index is obtained, which is taken as a reference for inflation. The report, published monthly, shows the variation in prices in three ways: monthly (comparing the last month with the previous month), year-on-year (last month with respect to the same month of the previous year or, in other words, 12 months); and accumulated (last month with respect to December of the previous year).

it is important to point out that the CPI is not a cost of living index, since this concept encompasses goods and services to achieve or maintain a certain level or social welfare, a situation of complex measurement due to the subjective elements involved in the valuation of each household. Bearing this in mind, we emphasize that the CPI measures the price level of a basket of selected goods and services, but not the cost of living.

Of course, not every index is perfect. For the basket of goods and services, the BCP uses the method of fixed weights. That is, the same relative weight is maintained for each item every month. This means that it does not reflect the variation in the quantity of certain goods in seasons of higher consumption and vice versa, making their incidence lower or higher than it would have been in the expenditure structure if the weights were variable. This makes it necessary to impute a price and freeze the index to certain items even when they disappear completely in certain periods. This would not be the case with variable weights. However, this would require a more periodic survey, which would require more resources, since seasonal fluctuations may be different from year to year. Thus, the solution, in some countries, generally consists of eliminating goods with seasonal demand from the CPI.

Finally, the result is a tool that, although it does not faithfully reflect monthly household consumption nor can it be considered a cost of living index, it is a valuable instrument for monitoring price levels and compliance with the inflation target. And, due to its rigorousness, it is used to index the various transactions in the economy.

Cover image: Pexels, Maurício Mascaro