Rodrigo Ibarrola

The idea that eliminating the Selective Consumption Tax (ISC) on fuels will reduce the price of fuels derived from oil has been widely spread, especially in the session of the Chamber of Deputies on March 24. This is under the mistaken premise of estimating the impact of the tax by deriving it from the retail price by applying the nominal tax rate. However, the tax regime does not work in the same way for the products we are referring to.

Law 6830/19 establishes that, in general, the ISC will be applied, for products manufactured in the country, after the first sale with respect to their ex-factory price or, for imported products, at the moment of their dispatch based on their declared customs value, after removal from the premises. However, certain petroleum products have a special regime.

In the case of diesel type 3, type III or type C, the taxable base for the tax is not the customs value or the price of sale to the consumer, but a fixed price determined by the Executive Power, by means of decrees 3109/19 and 6620/22, making use of its attributes, in accordance with art. 113 of the aforementioned law.

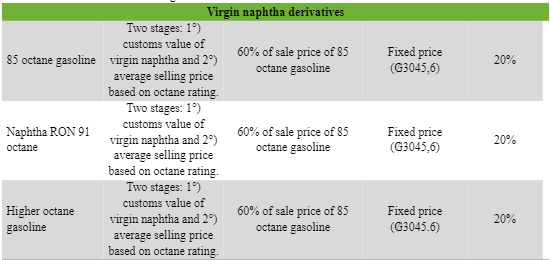

In the case of naphtha there were -until July 6, 2020- two scenarios, one of them, the sale of products derived from the importation of virgin naphtha. In this case the tax was liquidated and paid in two stages. The first one, at the National Customs Directorate (DNA), according to the customs value of the virgin naphtha, at the moment of withdrawal; and the second one, at the month of sale, based on the average retail price of the product. This is so because from the mixture of virgin naphtha with naphtha and ethanol fuels of different octane ratings are obtained, which are sold to the public at different prices. The rates are applied, in turn, according to each octane level, ranging from 20% to 38%. Thus, the tax determined in the first stage was considered as an advance payment. Subsequently, through Decree 3785, dated July 6, 2020, the second stage was eliminated and a mobile taxable base was established and, finally, with Decree 6620, dated February 4, 2022, a fixed price was established, as for type 3 diesel.

the ISC on fuels collected around US$350 million before the rebates began, according to estimates of the Ministry of Finance, the approximate equivalent of 1% of the Gross Domestic Product (GDP). Reducing it further will contribute to increase the fiscal deficit, without significant effect. And, although we are in a difficult moment due to the international context, this should not be an excuse to propose measures without prior analysis.

Thus, when the Undersecretariat of State for Taxation (SET) announced in February that it was reducing the ISC, what it actually did was to reduce the fixed price (taxable base) used to calculate the tax. And it went further, because it also determined prices for virgin naphtha -already mentioned- and 91 octane naphtha, which up to that moment were not covered by the taxable base measure. The evolution of the application of the ISC to fuels is shown in Table 1.

Table 1. Evolution of the application of ISC to petroleum fuels, selected products.

Source: Own elaboration based on Law 6380/19 and Decrees 3109/19, 3785/20, 6620/22.

In this indirect way, fixed prices were established for the liquidation of taxes without modifying the nominal rates, reducing the potential impact on the price of a tax decrease in the future. As a result, the effective tax rate, in practice, is much lower than the nominal rate by tying the tax base to fixed values, so that the amount of tax payable per liter becomes constant, even when the import or sales price is variable for the vast majority of the fuel marketed. Therefore, the effect of a possible elimination of the ISC would not be proportional to the nominal tax rate, nor would it generate the results claimed by the promoters of this initiative.

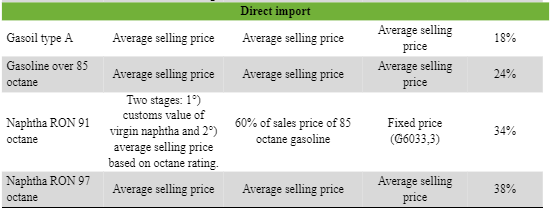

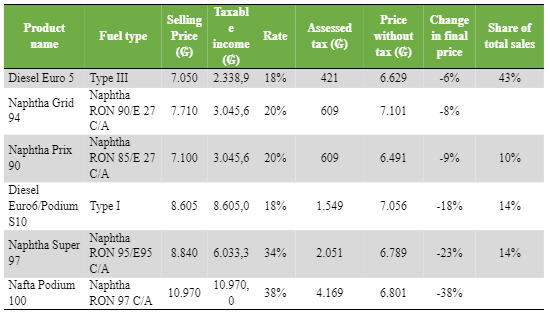

For further clarification, below is an exercise on the impact on retail prices that would result from the elimination of the ISC on fuels (Table 2), taking Petrobras as a basis. As a result, it can be seen that, if the ISC were eliminated, the price reduction in 72% of the fuels sold (Diesel Euro 5, Naphtha Grid 94, Naphtha Prix 90) would only range between ₲421 and ₲609 per liter, i.e. between 6% and 8% of the final price. With the clarification that it is assumed that Super 97 naphtha is marketed from RON 91, due to the fact that the importation of RON 95 by the company covers only 2% of sales, so it is clear that RON 91 or virgin naphtha is used as a base. However, the more expensive option is used for the calculation, so that the impact could, in practice, be lower if the product is only taxed on virgin naphtha.

Table 2. Calculation of the value of the tax for each type of fuel marketed at Petrobras

Source: Own elaboration with data from the Ministry of Industry and Commerce (MIC) and Petrobras. Note: Sales participation is based on data for 2021 and 2022.

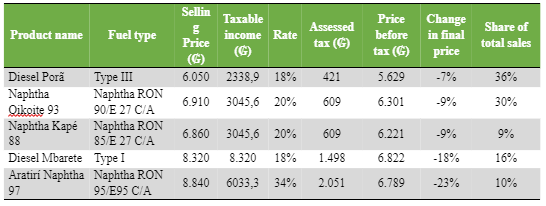

Similar results are obtained by applying the same routine to the state-owned company Petropar S. A. (Table 3). (Table 3). In this case, if the ISC were eliminated, the price reduction would affect 74% of the marketed fuels (Diesel Porã, Nafta Oikoite, Nafta Kape 88) with the same nominal values, but with a relative variation of only 7% to 9%. It is worth mentioning that the premise here is that Aratirí 97 naphtha is marketed from RON 91, since Petropar does not import higher octane naphtha and the import volume of the same is adjusted to that of the sale of Aratirí 97.

Source: Own elaboration with data from the Ministry of Industry and Commerce (MIC) and Petropar. Note: Share of sales is determined using data for 2021 and 2022.

In parallel to the proposal to eliminate the ISC, the idea of replacing it with the Value Added Tax (VAT) has been floated, so it is worth adding some comments in this regard. Although there are no specific estimates -at least not publicly available-, it should be borne in mind that the commercialization chain consists of at least three actors: importers, distributors and operators or service stations. Since VAT is levied on the value added at each stage of the process, assuming that each actor adds nothing more than a gross margin of 10%, the tax could easily reach an incidence of 37% on the import value, which is passed on to the final consumer. This would have the opposite effect to the desired one.

“All models are wrong, but some are useful,” said the English statistician George Box. Accepting some inaccuracies is the price to pay for knowledge. The objective is not to know exactly, but to have reasonable and honest approximations that allow information to be obtained for decision making. Accepting the limitations of these approximate calculations – it is impossible to know with precision the octane number obtained from the blend of virgin naphtha -, from this we can extract that the Vice Minister of Taxation, Oscar Orué, is right in affirming that the elimination of the ISC would not generate the price reduction so much announced, since, in 72% of the cases, the same would not be greater than ₲609 per liter. In fact, for the most consumed fuel, it would only be ₲421. The largest decreases would be in the types of fuels used by high-end vehicles used and, consequently, would benefit families in higher socioeconomic strata.

The limited impact is the result of the successive administrative dispositions that were taken by the SET for the liquidation of the tax and that significantly reduced the incidence of the tax in the final price. Therefore, it is not true that the ISC is the cause of high prices nor that its elimination will lower prices in a relevant way.

Finally, it goes without saying that the ISC on fuels collected around US$350 million before the rebates began, according to estimates of the Ministry of Finance, the approximate equivalent of 1% of the Gross Domestic Product (GDP). Reducing it further will contribute to increase the fiscal deficit, without significant effect. And, although we are in a difficult moment due to the international context, this should not be an excuse to propose measures without prior analysis.

Cover image: Freepik